Carmeuse Holding S.A. (“CH”)

Update Latest : 31 May 2020

Address

9 Avenue Guillaume, L-1651 Luxembourg

Telephone : + 352 264 585 23

Facsimile : + 352 264 417 99

Company Registration Number : B114218

Business Operation

CH is a Luxembourg-registered parent company of the Carmeuse Group, an international producer of lime and lime-related products with more than 160 years of experience in the extraction and processing of limestone and dolomitic stone into lime and lime-related products for industrial and commercial customers. As the world’s second largest producer of lime and limestone products, CH and its subsidiaries, associated and related companies operate through wholly owned subsidiaries, joint ventures and equity investments and have facilities in several countries including the Netherlands, Belgium, Luxembourg, Italy, Switzerland, Turkey, Ghana, USA, Canada, Romania, Hungary, Bosnia, Serbia, Czech Republic, Slovakia, Oman and Thailand. What contributes to CH as a leader in its industry is the combination of cutting-edge technologies, a commitment to quality, coupled with a dedication to environmental care and resource management that is the standard in its field

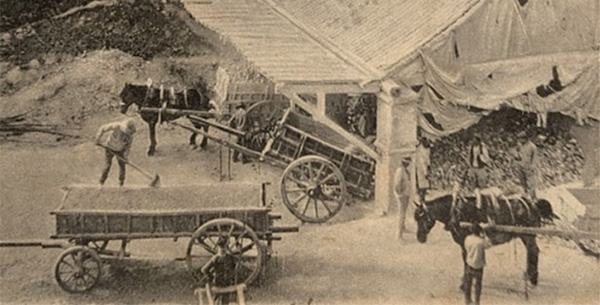

The Carmeuse Group, with a long and robust history beginning in 1860 in the middle of the industrial revolution, was founded by Mr. L?on Collinet as the Belgian-based, family-owned quarrying operation. CH has grown into a global presence in the limestone and lime products industry. CH succeeded in bringing together several independent quarries to become one of the major Belgian players and in getting through the wars and crises of the 20th century. At the beginning of the eighties, CH expanded outside its borders, first in the neighboring countries like France and the Netherlands but also in Italy and then rapidly in the United States and Canada. During the nineties, CH continued to grow in Turkey and West Africa. At the turn of the century, CH took on a new dimension in Central Europe and in more recent years started to expand also into the Middle East and South-East Asia. CH is now one of the major producers of lime and limestone related products. Its products are used in numerous and unsuspected applications providing for daily and essential needs.

The principal products of CH include high-calcium quicklime and hydrated lime, dolime and dolomitic hydrated lime which are used in a variety of industrial and commercial sectors, including the iron and steel, building and construction, waste and water treatment, chemical, paper, oil and gas, and glass industries. CH also sells crushed and pulverized limestone and dolomitic stone, as well as aggregates, which are used mainly in road construction and cement and concrete manufacturing. CH is also developing products for the sale of precipitated calcium carbonate, flue gas desulphurization, water treatment, and other applications.

Registered and paid-up capital

CH has total registered and paid-up capital of EUR 157,089,100, comprising an aggregate number of 448,826 ordinary shares, with par value of EUR 350.

Shareholders of the Company

The majority of the outstanding ordinary shares of Carmeuse Holding S.A. are in bearer form. Luxemburg law obliges companies with bearer shares to designate a depository that holds bearer shares for the account of the bearer shares’ owners. However, the depository has a duty of confidentiality and cannot reveal the names of these owners unless to certain designated Luxembourg governmental authorities and in particular instances as defined in the law. The Offeror received a confirmation from CH that, as part of the banks’ know-your-customer (KYC) requirements with regards to CH and its associated companies/subsidiaries, the banks have indeed in the past confirmed with the depository that it has been appointed as depository and the number of bearer shares deposited with it. The names of the owners were however not revealed for the aforementioned reasons. The banks accepted the information in such form as evidence to fulfill their KYC requirements concerning CH’s shareholding structure. To the best of CH’s knowledge, the descendants of the extended families of Mr. L?on Collinet, the founder of Carmeuse Group, collectively and indirectly own, on a fully diluted basis, more than 60.00% of the outstanding ordinary shares of CH, which are also in bearer form. Cobepa S.A., a Brussels-based privately-held investment company with a diversified investment portfolio valued at EUR 1,800 million, indirectly owns 20.00% of the outstanding ordinary shares of CH. Limelux S.A., an investment vehicle, is a Luxembourg registered company which owns 4.00% of the outstanding shares of CH. The vast majority of the remainder of CH’s outstanding ordinary shares is held by other individual or institutional shareholders. Other than as described above, the Offeror is not aware of any single shareholder who directly or indirectly owns more than 3.00% of CH’s outstanding ordinary shares on a fully diluted basis. To the best of the Offeror knowledge there are agreements in place between the descendants of the extended families of Mr. L?on Collinet, the founder of Carmeuse Group, Cobepa and Limelux aimed at protecting some minority shareholders rights; none of Carmeuse Group entities are a party to such agreements. The Offeror is not aware of any cross-shareholding amongst the descendants of the extended families of Mr. L?on Collinet, Cobepa, and Limelux.

The Board of Directors of the Company

Members of the Board of Directors of CH as at 31 May 2020

| No | Name | Position |

|---|---|---|

| 1 | Mr. Axel Miller | Chairman of Board of Directors |

| 2 | Mr. Baron Rodolphe Collinet | Director / CEO |

| 3 | Mr. Vicomte Philippe De Spoelbergh | Director |

| 4 | Newanda SCS, Represented By Mr. Daniel Gauthier | Director |

| 5 | Mr. Jean-Marie Laurent Josi | Director / Audit Committee |

| 6 | Mr. Philippe Tomson | Director |

| 7 | Mr. Bernard Woronoff | Director / President Audit Committee |

| 8 | Ms. Barabara t’Kint de Roodenbeke | Director |

| 9 | Mr. Roberto Gualdoni | Director |

| 10 | SPRL BC Conseil , Represented By Mr. Bernard Delvaux | Director |

| 11 | Mr. Baron Dominique Moorkens | Director |

Carmeuse Middle East & Asia S.A. (“CMEA”)

Update Latest : 31 May 2020

Address

9, avenue Guillaume, L-1651 Luxembourg

Telephone : + 352 264 585 23

Facsimile : + 352 264 417 99

Company Registration Number : B165367

Business Operation

CMEA is a Luxembourg-registered wholly owned subsidiary of Carmeuse Holding S.A. CMEA serves as a holding company to pursue investment opportunities in the lime and limestone business in the Middle-East and South East Asia. CMEA created a branch in Dubai to commercialize lime products into the Middle-East and India. The company owns 10.00% minority interest of Majan Mining LLC, a company operating a limestone quarry in Salalah, Sultanate of Oman. The company also owns 51.00% of Carmeuse Majan LLC, a company operating a state of the art lime production plant in Sultanate of Oman. In 2015, the Company also invested in 51.00% of Carmeuse Eastern Pte. Ltd., a private limited company incorporated and domiciled in the Republic of Singapore, aiming at supporting the development of Carmeuse Holding S.A. in Southeast Asia Region.

Registered and paid-up capital

CMEA has total registered and paid-up capital of EUR 23,000,000, comprising an aggregate number of 230,000 ordinary shares, with par value of EUR 100.

Shareholders of the Company

CMEA is a wholly owned subsidiary of Carmeuse Holding S.A. as at 31 May 2020

The Board of Directors of the Company

Members of the Board of Directors of CMEA as at 31 May 2020

| No | Name | Position |

|---|---|---|

| 1 | Mr. Rodolphe Collinet | Chairman of Board of Directors / CEO |

| 2 | Ms. Danielle Knott | Director |

| 3 | Mr. Yves Schoonejans | Director |

| 4 | Mr. Dominique Collinet | Director |

| 5 | Mr. Yves Willems | Director |

| 5 | Mr. Tim Van den Bossche | Director |

Carmeuse Eastern Pte. Ltd. (“CE”)

Update Latest : 31 May 2020

Address

24, Raffles Place, #18-00, Clifford Centre, Singapore-048621

Telephone : +65 6533 2323

Facsimile : +65 6533 7029

Company Registration Number : 201220139W

Business Operation

CE is a holding company and was set up in Singapore by Carmeuse Middle East & Asia S.A. and Eastern Energy Inc. to explore business opportunities in Asia and the Middle East. The primary purpose of this company is to hold shares in Asia Lime Pte Ltd which is the investment vehicle for the Group in the region.

Registered and paid-up capital

CE has total registered capital and paid-up capital of USD 17.899.510, comprising an aggregate number of 17.899.510 ordinary shares, with par value of USD 1.

Shareholders of the Company

List of shareholders of CE as at 31 May 2020

| No | Name | No. of shares | % comparing to the total paid-up shares | % comparing to the total voting rights |

|---|---|---|---|---|

| 1 | Carmeuse Middle East & Asia S.A. | 9.128.750 | 51.00 | 51.00 |

| 2 | Eastern Energy Inc. | 8.770.760 | 49.00 | 49.00 |

| Total | 17.899.510 | 100.00 | 100.00 |

The Board of Directors of the Company

Members of the Board of Directors of CE as at 31 May 2020

| No | Name | Position |

|---|---|---|

| 1 | Mr. Ajaib Hari Dass | Director |

| 2 | Mr. Krishnan Subramanian Aylur | Director |

| 3 | Mr. Ishaan K Shah | Director |

| 4 | Mr. Yves Jacques Schoonejans | Director |

| 5 | Ms. Kristel Verleyen | Director |

Asia Lime Pte. Ltd. (“ALS”)

Update Latest : 31 May 2020

Address

24, Raffles Place, # 18-00 Clifford Centre, Singapore, 048621

Telephone : +65 6533 2323

Facsimile : +65 6533 7029

Company Registration Number : 201220131K

Business Operation

ALS is a wholly owned Singapore-registered subsidiary of Carmeuse Eastern Pte. Ltd. and was set up as a regional headquarter for Southeast Asia to look at suitable investment opportunities, including lime and lime related businesses in the region with a view to expanding its geographical reach and grow both organically and through strategic acquisitions. At present, Asia Lime Pte. Ltd. major investment in Thailand is in CE Lime (Thailand) Limited, which currently own 73.79% shares in Golden Lime Public Company Limited

Registered and paid-up capital

ALS has total registered and paid-up capital of USD3,550,000, comprising an aggregate number of 3,550,000 ordinary shares, with par value of USD 1.

Shareholders of the Company

ALS is a wholly owned subsidiary of Carmeuse Eastern Pte. Ltd. as at 31 May 2020

The Board of Directors of the Company

Members of the Board of Directors of ALS as at 31 May 2020

| No | Name | Position |

|---|---|---|

| 1 | Mr. Ajaib Hari Dass | Director |

Carmeuse Group

Carmeuse group is indirectly shareholding which hold shares in CE LIME (Thailand) Ltd., the major shareholder of Golden Lime Public Company Limited (SUTHA.)

Website : www.carmeuse.com

Founded in 1860, in the middle of the industrial revolution, by L?on Collinet, the Belgian-based, family-owned quarrying operation Carmeuse has grown into a global presence in the limestone and lime products industry.

Carmeuse succeeded in bringing together several independent quarries to become one of the major Belgian players and in getting through the wars and crises of the 20th century. Beyond the figures, balance sheets, difficulties and successes, this is the story of a great adventure. The story of thousands of " Carmeusians " who, throughout a century and a half of work, passion and commitment, contributed to making Carmeuse a Belgian industry flagship worldwide.

At the beginning of the eighties, the company expanded outside its borders. First in the neighboring countries like France and the Netherlands but also in Italy and then rapidly in the United States and Canada.

During the nineties, it continued to grow in Turkey and West Africa.

At the turn of the century, Carmeuse took on a new dimension in Central Europe.

Carmeuse is now one of the major producers of lime and limestone related products including quick lime, hydrated lime and dolomite. Its products are used in numerous and unsuspected applications providing for daily and essential needs.

An industrial saga of that sort can only be built upon and perpetuated by the unfailing respect of essential values. Such values have guided the " Carmeusians " throughout their history and still prevail today.

GP Group

GP group is indirectly shareholding which hold shares in CE LIME (Thailand) Ltd., the major shareholder of Golden Lime Public Company Limited (SUTHA.)

Website : www.premjee.com

History

Key Events That Have Shaped the GP Group for Over a Century

1868 GP Group was officially founded in Yangoon, Myanmar Named after two men, a merchant and his son – Ketsee and Devjee – the company was called Gangjee Premjee & Co, and specialized in trading rice sourced from Burma, Vietnam, and Thailand.

1918 Gangjee Premjee & Co moved its operational base to Thailand and Premjee’s only son Chimanlal became the only non-Chinese rice trader in Bangkok.The Premjee family later adopted the surname “Shah,” which means “merchant” or “trader” in the West Indian region of Gujarat. Chimanlal then became widely known as “the Shah of Bangkok” for his hospitality, extending an open-door policy to the local Indian community.

1976 Chimanlal’s son, Kirit, was encouraged by his father to travel the world for fresh ideas and to meet with present and prospective customers. He returned from the trip with a realization that the company needed diversification. Thanks to his vision, Gangjee & Premjee & Co began dealing in a wide variety of commodities.

1980s When Kirit was appointed Chairman of the Group, he continued to diversify, adding heavy industries such as coal and steel, to consumer goods like cooking oil and canned goods to the portfolio. He also formed new companies including the first Thai enterprise to manufacture raw pharmaceutical chemicals.Kirit also guided the launch of Precious Shipping Ltd., the first dry bulk company to sail its way onto the Stock Exchange of Thailand.

1990s The company was renamed to G Premjee. It added real estate and construction ventures to its portfolio. By

1996, G Premjee owned or had interests in over 150 different companies. The company, now called the GP Group, enjoyed a remarkable recovery during the Asian Economic Crisis of 1997.

2002 After graduating from Boston University, Kirit’s eldest daughter Nishita joined the Shah family business, serving as the director on various boards ranging from shipping and mining to pharmaceuticals and aviation.

2006 With 44 vessels, Precious Shipping Ltd. became Thailand’s second largest shipping company. Its financial performance was ranked no. 1 internationally by the prestigious Marine Money magazine.

2007 Nishita was appointed Managing Director of the GP Group. She became the Group’s new public face and was also included on the Top 20 list of richest tycoons by Forbes Asia.

2013 Chairman Kirit Shah turned 60, while the company celebrated 145 years of its success as a family business.

Mr. Krishnan Subramanian Aylur

Update Latest : 31 May 2020

Profile :

| Name | Mr. Krishnan Subramanian Aylur |

|---|---|

| Age | 52 Years |

| Address | 168/66 Soi Sukhumvit 23 Bangkok 10110 Thailand |

| Education |

|

Work Experience :

| Year | Position |

|---|---|

| 13 May 2020 - Present | Director, Thai Marble Corp Limited |

| 2016 - Present | Director, Golden Lime Public Company Limited and Subsidiaries |

| 2016 - Present | Director, CE Lime (Thailand) Limited |

| 2015 - Present | Director, Carmeuse Eastern Pte. Ltd. |

| 2015 - Present | Director, Carmeuse Siam Ltd. |

| 2015 - Present | Director, Associated Industries Ltd. |

| 2013 - Present | Director, Eastern Energy Chartering Pte. Ltd. |

| 2006 - Present | Director, Majan Mining Co LLC |

| 2004 - Present | Vice President, Premthai International Ltd. |

| 2002 - Present | Director, Eastern Energy Pte. Ltd. |

| 2001 - Present | Director, Eastern Energy Inc. |

Mr. Ishaan Shah

Update Latest : 31 May 2020

Profile :

| Name | Mr. Ishaan Shah |

|---|---|

| Age | 32 Years |

| Address | 25/1 Soi Sukhumvit 13, Khlong Toey NuaWattana, Bangkok 10110, Thailand |

| Education | Bachelor of Science in Business Administration, concentrations in Finance and Law, University of Southern California, Los Angeles, CA, United States |

| Training | Director Certificate Program (DCP) by Institute of Directors (IOD) Seatrade Academy, University of Cambridge, The United Kingdom |

Work Experience :

| Year | Position |

|---|---|

| 2017 - Present | Director, Golden Lime Engineering Co.,Ltd. |

| 2016 - Present | Director, CE Lime (Thailand) Limited |

| 2013 - Present | Director, Mega Lifesciences Public Company Limited |

| 2012 - Present | Director, Christiani & Nielsen (Thai) Public Company Limited |

| 2011 - Present | Director, Precious Shipping Public Company Limited. |

| 2008 - Present | Director, Globex Corporation Limited |

| 2008 - Present | Director, Graintrade Limited |

Eastern Energy Inc. (“EEI”)

Update Latest : 31 May 2020

Address

ADR Building, 13th floor Samuel Lewis Avenue & 58th Street, Panama, Republic of Panama

Telephone : +507 269 2255 / 264 8911

Facsimile : +507 246 7033 / 269 1552

Company Registration Number : 394388/194339

Business Operation

EEI is a Panama-registered holding company for investments in mining and downstream industries, commodity trading and shipping. EEI and its subsidiaries have invested in various joint ventures and equity investments in several countries including Thailand, Singapore, and Oman. In Singapore, the company has two businesses; one focused on chartering of ships for freight and the other in solid fuel trading business.

In Oman, EEI has a majority stake in Majan Mining Co., Ltd, the owner and operator of the largest limestone quarry in Salalah. Through its wholly owned subsidiary, Oman Lime Pte. Ltd., EEI also holds a minority stake in Carmeuse Majan SFZ, a producer of lime for domestic and export markets.

Registered and paid-up capital

EEI has total registered and paid-up capital of USD 100,000, comprising an aggregate number of 1,000 ordinary shares, with par value of USD 100.

Shareholders of the Company

List of shareholders of EEI, as at 31 May 2020

| No | Name | No. of shares | % comparing to the total paid-up shares | % comparing to the total voting rights |

|---|---|---|---|---|

| 1 | Mr. Ishaan Shah | 90 | 90.00 | 90.00 |

| 2 | Mr. Krishnan Subramanian Aylur | 10 | 10.00 | 10.00 |

| Total | 100 | 100.00 | 100.00 |

The Board of Directors of the Company

Members of the Board of Directors of EEI as at 31 May 2020

| No | Name | Position |

|---|---|---|

| 1 | Mr. Ishaan Shah | Director |

| 2 | Mr. Krishnan Subramanian Aylur | Director / President |

| 3 | Mr. Shirish Sharma | Director / Treasurer |

CE Lime (Thailand) Limited (“CELT”)

Update Latest : 31 May 2020

Address

8/25 Cathay House 6th Floor, North Sathorn Road Silom Sub-District, Bangrak District, Bangkok 10500

Telephone : 02-696-8720

Facsimile : 02-696-8753

Company Registration Number : 0105559150061

Business Operation

CE Lime (Thailand) Limited (the “Offeror” or “CELT”) is established by Mr. Ishaan Shah and Asia Lime Pte. Ltd. as a holding company primarily for the purpose of investing in lime and lime related businesses.

Registered and paid-up capital

CELT has total registered and paid-up capital of THB 175,000,000, comprising an aggregate number of 1,750,000 shares, 857,500 of which are ordinary shares and the rest are preferred shares, with par value of THB 100.

Shareholders of the Company

List of shareholders of CELT as at 31 May 2020

| No | Name | No. of shares | % comparing to the total paid-up shares | % comparing to the total voting rights |

|---|---|---|---|---|

| 1 | Mr. Ishaan Shah | 892,499 | 51.00 | 34.23 |

| 2 | Asia Lime Pte. Ltd. | 857,500 | 49.00 | 65.77 |

| 3 | Mr. Krishnan Subramanian Aylur | 1 | 0.00 | 0.00 |

| Total | 1,750,000 | 100.00 | 100.00 |

Note :

- 892,499 shares of Mr. Ishaan Shah and one share of Mr. Krishnan Subramanian Aylur are in form of preferred shares. Two preferred shares are entitled to one voting right.

- 857,500 shares of Asia Lime Pte. Ltd. are in form of ordinary shares. Each ordinary share is entitled to one voting right.

The Board of Directors of the Company

Members of the Board of Directors of CELT as at 31 May 2020.

| No | Name | Position |

|---|---|---|

| 1 | Mr. Ishaan Shah | Director |

| 2 | Mr. Krishnan Subramanian Aylur | Director |

| 3 | Mr. Shiraz Erach Poonevala | Director |

| 4 | Mr. Geza Emil Perlaki | Director |

Golden Lime Engineering Company Limited (“GLE”)

Update Latest : 31 May 2020

Address

89 Cosmo Office Park, 6th Floor, Unit H, Popular Road, Banmai, Pakkret, Nonthaburi 11120, Thailand

Business Operation

Golden Lime Engineering Company Limited (“GLE”) is established on 15 March 2017 by Golden Lime Public Company Limited (the major shareholder) for the purpose of the Engineering consulting services and Engineering designs, production and supply of machinery/equipment and sparepart including supervisory of installation.

Registered and paid-up capital

GLE has total registered capital and paid-up capital of THB 20 million, comprising an aggregate number of 2,000,000 ordinary shares, with par value of THB 10.

Shareholders of the Company

List of shareholders of GLE as at 31 May 2020

| No | Name | No. of shares | % comparing to the total paid-up shares | % comparing to the total voting rights |

|---|---|---|---|---|

| 1 | Golden Lime Public Company Limited | 1999998 | 99.99990 | 100.00 |

| 2 | Mr.Ishaan Shah | 1 | 0.00005 | |

| 3 | Mr.Krishnan Subramanian Aylur | 1 | 0.00005 | |

| Total | 2,000,000 | 100.00 | 100.00 |

The Board of Directors of the Company

Members of the Board of Directors of GLE as at 31 May 2020

| No | Name | Position |

|---|---|---|

| 1 | Mr. Bernard Jules A Maiter | Director |

| 2 | Mr. Krishnan Subramanian Aylur | Director |

| 3 | Mr. Geza Emil Perlaki | Director |

| 4 | Mr. Ishaan Shah | Director |

Authority of the authorized Directors of the Company

Any two of Directors jointly sign with company seal affixed

Saraburi Quicklime Company Limited (“SQL”)

Update Latest : -

| Company Name | Saraburi Quicklime Company Limited (“SQL”) |

| Date of Acquisition of Share on | 19 March 2018 |

| Location | 39/2 Moo. 9, Pukkgrang Sub-district, Phabudhabaht district, Saraburi 18120. |

| Business operation | Manufacturer and distributor of Lime (Calcium Oxide and Calcium Hydroxide) |

| Registered Capital | THB 38,800,000 number of shares 48,500 Ordinary shares with par value of THB 800 |

| Paid-up Capital | THB 38,800,000 |

| Registered the liquidation date on 17 December 2019 The liquidators are; | 1. Mr. Geza Emil Perlaki 2. Mr. Krishnan Subramanian Aylur |

| The liquidator can jointly perform on behalf of the Company unless in following event which | Define separate authorization is any process to complete the company dissolution and liquidation, one liquidator can sign |

The board of directors of Golden Lime Public Company Limited (“the Company or SUTHA”) No. 3/2019 has the resolution on May 14, 2019 to consider the restructuring of a company group as the Company will acquire the entire business of Saraburi Quicklime Co., Ltd (“SQL”), a subsidiary of the Company, under the entire business transfer scheme (“EBT”). By proposing to the Extraordinary General Meeting of Shareholders No. 1/2019, which held on 14 August 2019, approving the implementation of the said plan. The value of the purchase and transfer of the entire business is approximately 209 million baht, which is the preliminary value, which the Executive Committee meeting of the company held on July 19, 2019 has disclosed the value from the fair value. The said value is calculated from the appraisal price of land, building and equipment evaluated by the independent appraiser and net book value of the entire business. However, the said value can be altered according to the change of net book value of shareholder’s equity of SQL at the effective date. And requested the shareholders’ meeting to authorize the board of directors, executive committee, authorized director(s); and/or person(s) entrusted by the board of directors executive committee and/or authorized director(s) to be empowered to approve, determine and/or amend the details and any conditions in connection with or necessary for the above entire business transfer transactions such as the date of transfer, price and term of payment including negotiation, discussion and signing in the documents and other relevant agreements and any actions which are necessary for entire business transfer and liaison with government authorities by the Company appointed the Legal & Tax Advisor from KPMG Phoomchai Tax Ltd. to proceed until process completed.

The acquisition of entire business was done completely on December1, 2019, with a total purchase and business transfer value of 123.20 million baht. The said value is a fair value which is calculated from the appraisal price of land, building and equipment evaluated by the independent appraiser and net book value of the entire business as of November 30, 2019. In this regard, SUTHA registered the business which acquired from Saraburi Quicklime Co., Ltd. as the Branch No. 00004 and there is a transfer of a factory operation license. Including all operating permits and ownership of land and buildings, other assets include cash, bank deposits, trade accounts receivable. And all other current assets as well as the debt burden with trade and financial institution creditors to Golden Lime Public Company Limited, the transferee of business. And Saraburi Quicklime Co., Ltd.(a subsidiary company) registered the dissolution with the appointment that the company's liquidator on 17 December 2019 with the Department of Business Development Ministry of Commerce Currently, the company is in the process of liquidation.

Due to the restructuring of group of company under the common control, this restructuring transaction is not subject to the regulation of the acquisition or disposition of assets pursuant to Notification of the Capital Market Supervisory Board No. TorChor. 20/2551 Re: Rules on Entering into Material Transactions Deemed as Acquisition or Disposal of Assets dated 31st August 2008 and Notification of the Board of Governors of the Stock Exchange of Thailand Re: Disclosure of Information and Other Acts of Listed Companies Concerning the Acquisition and Disposition of Assets B.E. 2547 dated 29th October 2004 and also, not subject to the regulation of the connected transactions according to Notification of the Capital Market Supervisory Board No. TorChor. 21/2551 Re: Rules on Connected Transactions dated 31st August 2008 and the Notification of the Board of Governors of the Stock Exchange of Thailand Re: Disclosure of Information and Other Acts of Listed Companies Concerning the Connected Transactions B.E. 2546 dated 19th November 2003. However, to comply with section 107 (2)(b) of the Public Limited Company Act B.E. 2535, the Company will present this matter to shareholders’ meeting for approval.

The acquisition of the entire business of SQL in order to have only the Company undertaking this business. Please see the details of the restructuring plan below.

Note : As of 1 December 2019 is in the process of liquidation.

Note : As of 1 December 2019 is in the process of liquidation.

Which takes approximately not less than 1 year

The restructuring of a company group will increase the effectiveness and benefits to the group of companies as follows:

- The Company would be the operator to conduct the business of manufacture and distributor of Lime solely, as by acquiring SQL’s business altogether, it will increase the effectiveness of its management and operation in term of business and legal for approval processes from directors and shareholders.

- Due to the restructuring of a group of company, the Company, as a public company limited and listed on the SET, will be the transferee company and will be enhance the trustworthiness as well as increase confidence to business partners, investors, and distributors for future business expansion.

- The restructuring of a company group under the EBT scheme will decrease the related party transaction between the company with a subsidiary company and it will reflex an actual value of business of manufacture and distribute of Lime and decrease the costs and other unnecessary expense. By EBT method, the Company has less costs and saving tax.

- The EBT will be undertaken in accordance with the Thai Revenue Code and there will be no tax implications on transferring assets pursuant to section 74 (b)(c) and VAT would be exempted as it is not considered as a sale pursuant to section 77/1 (8)(f) including relevant taxes such as specific business tax and stamp duty.

Golden Lime Public Company Limited

| Free Float As of 14/03/2022 | |

|---|---|

| Minor Shareholders (Free float) | 1,491 |

| % Shares in Minor Shareholders (% Free float) | 21.56 |

| Overview As of 14/03/2022 Rights Type : XM | |

|---|---|

| Total Shareholders | 1,642 |

| % Shares in Scripless Holding | 100.00 |

Major Shareholder as of 23 May 2025

| NO | NAME | NUMBER OF SHARES | % SHARES |

|---|---|---|---|

| 1 | ºÃÔÉÑ· «ÕÍÕ äÅÁì (»ÃÐà·Èä·Â) ¨Ó¡Ñ´ | 276,725,575.00 | 76.36 |

| 2 | ¹Ò»Ñé¹ ÊÒÃÊÒÊ | 16,560,000.00 | 4.57 |

| 3 | ¹Ò¢ѹ¸ìྪà ÊÒÃÊÒÊ | 11,450,000.00 | 3.16 |

| 4 | BANQUE PICTET & CIE SA | 5,000,000.00 | 1.38 |

| 5 | ¹.Ê.µéͧÃÑ¡ ¡Ô¨ÇѲ¹ªÑ | 4,200,000.00 | 1.16 |

| 6 | MISSANUSARA PUTTARAKSA | 3,031,500.00 | 0.84 |

| 7 | ¹Ò¡ԵÔÈÑ¡´Ôì »ÔÂоѲ¹Ò | 2,499,000.00 | 0.69 |

| 8 | ¹ÒÂÍѤþ§Éì ⪵ԤéÓǧÈì | 2,224,450.00 | 0.61 |

| 9 | MR.NATTAPAN TANUNGTANURAK | 2,000,000.00 | 0.55 |

| 10 | MISSJINTANA THANAVUTVATTHANA | 1,411,125.00 | 0.39 |